Companies need to know about SFT Compliance

I. Introduction:

The Government of India along with the Ministry of Finance has widened the tax base. Which has resulted in bringing more and more compliance responsibilities on the companies. Companies must be aware that non-compliance with respect to certain high-value transactions might get them an Income Tax notice. The Income-tax department requires companies to submit a statement of Specified Financial Transactions (SFT). SFT reporting is mandatory for certain reporting entities from Finance Act 2014 by introducing section 285BA followed by additions made in Finance Act 2020 through notification no. 16/2021, dated 12-03-2021. This article focuses on SFT reporting which is applicable to the companies and documents require for reporting such transactions.

II. Why SFT has been introduced?

SFT Reporting has been introduced to -

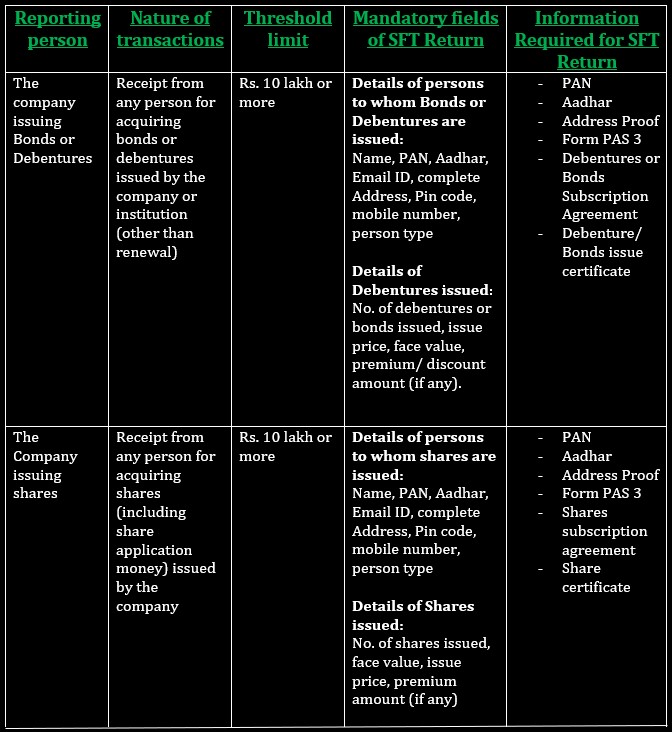

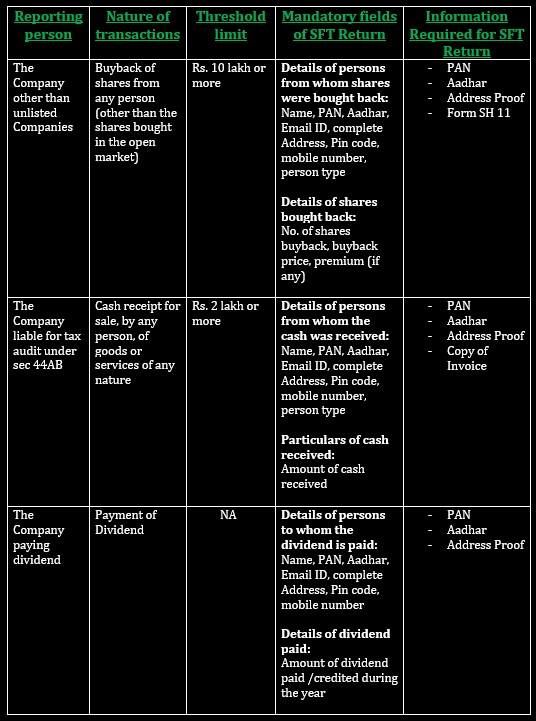

III. Nature & value of Reportable Transactions:

The below-mentioned table shows the nature of the transactions to be reported and documents require to file SFT:

Ⅳ.Rectification of SFT Report:

Rectification of SFT report can be done in two cases viz. in case of rejected statement & in case the report is processed with some defects or exceptions-

- In case of rejected statements, no statement ID is generated & the return needs to be resubmitted by validating errors. The process of resubmission of rejected statement is the same as the case of uploading the original statement.

- But in case the return is processed with defects or exceptions, the return needs to be resubmitted as per the below-mentioned steps-

- Log into SFT Portal & download the DQR file statement which has defects. DQR is a XML file. This DQR file is to be downloaded from the statements pending for correction tab under the statement head. OR we can also download the DQR file from the generic submission utility. In such utility go to the tab download DQR. Enter the user ID & password of the SFT portal & also enter the statement ID for which we want to download the DQR. Click on download DQR File.

- Now open th report generation & validation utility available on the portal & go to the View DQR tab.

- In this tab you need to upload the DQR report & corresponding original statement which you need to rectify. Make sure that the DQR file number & original file number should match.

- Defects & exceptions are highlighted in the validation error details sidebar. Click on the defects. It will open the corresponding defective entry. Correct all defects & validated the file.

- After the validation click on generate the XML file.

- Then submit the XML file through the generic submission utility. The entire procedure for submission of a defective report will remain the same as in the case of uploading the original statement.

Ⅴ. Advice:

- Companies need to focus on updating their ERP for SFT reporting compliance. Companies would have to work with their respective IT department & assess whether SFT reporting can be effectively implemented in the ERP. For effective SFT reporting through ERP system, the role of the IT department becomes crucial.

- If SFT reporting using ERP is not possible then companies would have to update their Internal Financial Controls relating to SFT reporting. Companies would be required to have a strong compliance reporting of SFT transactions to avoid delay in report filing & late fees.

Ⅵ. Conclusion:

Thus, by introducing SFT, Government will keep a watch on high-value transactions undertaken by the taxpayer. The company must be aware of all those compliances related to SFT transactions. Keeping in mind all the consequences of non-compliance, companies need to upgrade their systems according to the requirements and need to be responsible.

Authors:

CA Aakash Mehta

Partner | Email: aakash.mehta@masd.co.in

Varsha Dhake

Consultant | Email: varsha.dhake@masd.co.in

Vikash Parashkar | Associate Consultant

.svg)