Determining costing in Service Industry:

Introduction:

Determining costing in a service industry is an essential concept since every service organization needs to ascertain its business overheads as service sector companies provide their customers with services or intangible products. Put simply, the term service costing or operational costing refers to the computation of the total operational cost incurred on each unit of the intangible product. The selection of cost unit for service sector is relatively difficult to ascertain as compared to the selection of cost unit for manufacturing sector.

Determining the cost unit in Service Costing:

To measure the cost of business operations in a service industry is a complex activity where all the cost parameters are to be considered while deciding a suitable unit for costing.

Following are the two different kinds of cost unit ascertained under service costing:

Determining the billing rate:

In service industry, the billing rate is the amount a company or professional charges per hour of work. Calculation of an appropriate bill rate is necessary so that you don’t undersell your services or lose your contract to another consultant. To calculate the billing rate, follow the below-mentioned steps-

Step 1: Add up all the expenses that need to be covered/incurred

Step 2: Out of the total time covered by salaries, determine how many staff hours are actually available for client projects i.e., subtracting all non-billable time from the total, chances are that only 70% of the annual schedule is available for client projects. i.e., Consider only total chargeable hours

Step 3: Determine a target profit percentage to be built into your hourly rate. For planning purposes, organizations should not hesitate to be more aggressive about their target profit. Some creative firms are able to achieve a net profit as high as 15 or 20 percent, depending on the type of services being sold and the strength of the firm's reputation.

Step 4: Put all the above components together to determine your hourly rate: Total costs to be covered

÷ by total chargeable hours

= breakeven rate

+ target profit percentage

= hourly rate to use for project planning purposes

Because labour expenses and overhead expenses change over time, it's a good idea to recalculate this rate once or twice a year to make sure that it's current.

Costing methods used in service sector:

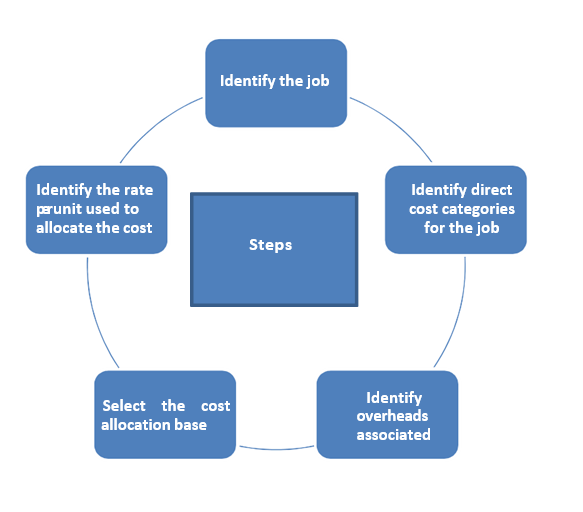

- Job Costing method: In Job costing method, the cost of a particular service is obtained by assigning costs to a distinct identifiable service.

As mentioned above, the five steps for assigning costs to individual jobs are as follows:

- Identify the job that is chosen as cost object: Let’s take an example to understand Accounting work for Motorola India Limited by an accounting firm will require 100 budgeted hours of professional labour.

- Identify the direct cost categories for the job: In the above instance, the professional hours required for doing the accounting work is a direct

- Identify indirect costs (overheads) associated with the job: This step requires identification of indirect costs incurred for providing These costs include cost of support labour, electricity charges, travelling, stationery cost, etc.

- Select the cost allocation base to be used in assigning each indirect cost to the job: This step requires the selection of cost allocation base that has a cause and effect relationship between changes in it and changes in the level of indirect

- Identify the rate per unit of the cost allocation base used to allocate cost to the job: The budgeted indirect cost allocation rate is computed by using following formula-

Budgeted indirect costs= Budgeted total indirect cost/ Budgeted total quantity of cost allocation base

- Process costing method in service sector: In this method, the cost of service is obtained by assigning costs to masses of units and then computing unit costs on an average Let’s understand with the illustration-

Illustration:

The loan department of a Bank performs several functions in addition to home loan application processing task. It is estimated that 25% of the total overhead cost of loan department are applicable to processing of home-loan application. The bank has processed 125 loan applications in the month of March’21.

Determine the cost of home-loan application department. The following information pertains to processing of loan application:

particulars

Rs.

Loan Processor’s monthly salary [ 4 employees @ Rs

20,000 each]

80,000

Loan Department’s overhead cost [monthly]:

Chief Loan Officer’s Salary

30,000

Telephone expenses

1,000

Depreciation on building

5,000

Advertising Cost

3,000

Miscellaneous Cost

1,000

Total Overhead Cost

40,000

Statement showing computation of cost of processing a typical home loan application:

Particulars

Rs.

Direct labour Cost

80,000

Service Overhead Cost [ 25% of 40,000]

10,000

Total Processing Cost per month

90,000

No. of applications processed in the month of March’21

125

Total Processing Cost per home loan application

720

Case-study:

“Sky-high hotel” is a lodging hotel which is being run in a small hill station with 100 single rooms. The hotel offers concessional rates during six off-Season months in a year. During this period, half of the full rent is charged. The managements have decided to keep a profit margin targeted at 20% of the room rent. As per the past year’s trend, occupancy during the season is 80% while in the off-season it is 40% only.

The hotel has total Investment worth Rs.200 Lakhs of which 80% relates to buildings and balance for furniture and equipment. The details of expenses incurred are-

- Expenses:

- Staff Salary [ Excluding room attendants]: 5,50,000

- Repairs to building: 2,61,000

- Laundry charges: 80,000

- Interior charges: 1,75,000

- Miscellaneous expenses: 1,90,000

- Room attendants are paid 10 per room day on the basis of occupancy of the rooms in a month

- Monthly lighting charges are 120 per rooms, expects in four months in winter when it is Rs.30 per room and this cost is on the basis of full occupancy for a Month.

- Depreciation is estimated at 5% & 15% on Building & Furniture

The management of Sky-High hotel also wanted to know the room rent to be charged in peak and non-peak season so that they achieve the target of 20% on sales after incurring the above-mentioned costs.

In the above scenario, cost computing will be done as follows:

Particulars

Amount (Rs.)

Staff Salary

5,50,000

Repairs to building

2,61,000

Laundry charges

80,000

Interior

1,75,000

Miscellaneous expenses

1,90,000

Depreciation (Note 1)

14,00,000

Room attendant's Wages (Note 3)

2,16,000

Lighting charges (Note 4)

72,000

Total Cost

29,44,000

Add Profit: 20%

7,36,200

Total Sales

36,81,000

Note 1:

Depreciation= 2,00,00,000 X 80%X 5%= 8,00,000 – On Building

Depreciation= 2,00,00,000 X 20%X 15%= 6,00,000- On Furniture Total= Rs 14,00,000/-

Note 2:Room Days [No. of rooms x no. of days]

Occupancy:

Season

100 Rooms x 80% x180 Days

14,400

Off- Season

100 Rooms x 40% x180 Days

7,200

Total Room days

21,600

Note 3: Calculation of Room attendant’s wages: -

Room attendant’s wages

Amount (Rs.)

Season

14,400 Room days x 10 Per room per day

1,44,000

Off Season

7200 Room days x 10 Per room per day

72,000

Total

2,16,000

Note 4: Calculation for Lighting Charges: -

1 year=12 months

Winter= 4 months Non-winter=8 months

Type

Season/Off Season

Particular

Amount

Winter

Off Season

100 Rooms x 40% x 30 per rooms x 4

Months

4,800

Non- Winter

Off Season

100 Rooms x 40% x 120 per rooms x 2 Months

9,600

Non- Winter

Season

100 Rooms x 80% x 120 per rooms x 6 Months

57,600

Total

72,000

Let the half rent per room per day be Rs. X. Therefore, Full rent per room per day be Rs.2X

Total Collection:

Off-seasonà 7,200 Room days * X per room day= 7,200 X Seasonà 14,400 Room days * 2X per room day=28,800X

Hence, 36,000 X= 36,81,800 Therefore, half rent=X= Rs 102.25/- & full rent=2X= Rs. 204.50/-

Cost Monitoring:

Not only determining appropriate costing will be helpful but cost monitoring is also very essential. Every company needs to have a long-term business strategy. Cost monitoring should be part of the strategy and be influenced by the strategy. Cost decisions should be measured against the company's strategy, rather than a current short-term situation. As part of your cost monitoring, benchmark yourself against other similar companies. What is the industry average spending in different areas? And how do your costs compare? Periodically review what you are doing and how you are doing it.

Conclusion:

Many business owners simply don't realize that determining appropriate costing is, in fact, the most vital component when it comes to making money. Price your services poorly, and you're leaving money on the table, price them well, and you'll beat out your competition without diminishing the perceived quality of your brand. Costing provides a proper roadmap to the organization for various factors such as providing guidelines for various managerial decisions like choose for either make or buy, utilization of idle plant capacity, launching of a new product so on and so forth. Organizations should focus on such products which are more profitable / segments which are helping them to earn more profits and should focus more on them. For segments which are non-profitable, organization should evaluate the reasons for the same and accordingly work on.

Authors:

CA Aakash Mehta Partner, MASD

E-mail ID: aakash.mehta@masd.co.in

Poojan Joshi

Associate Consultant, MASD

E-mail ID: poojan.joshi@masd.co.in

.svg)