How E-Invoicing works & It's Applicability under GST

- Introduction

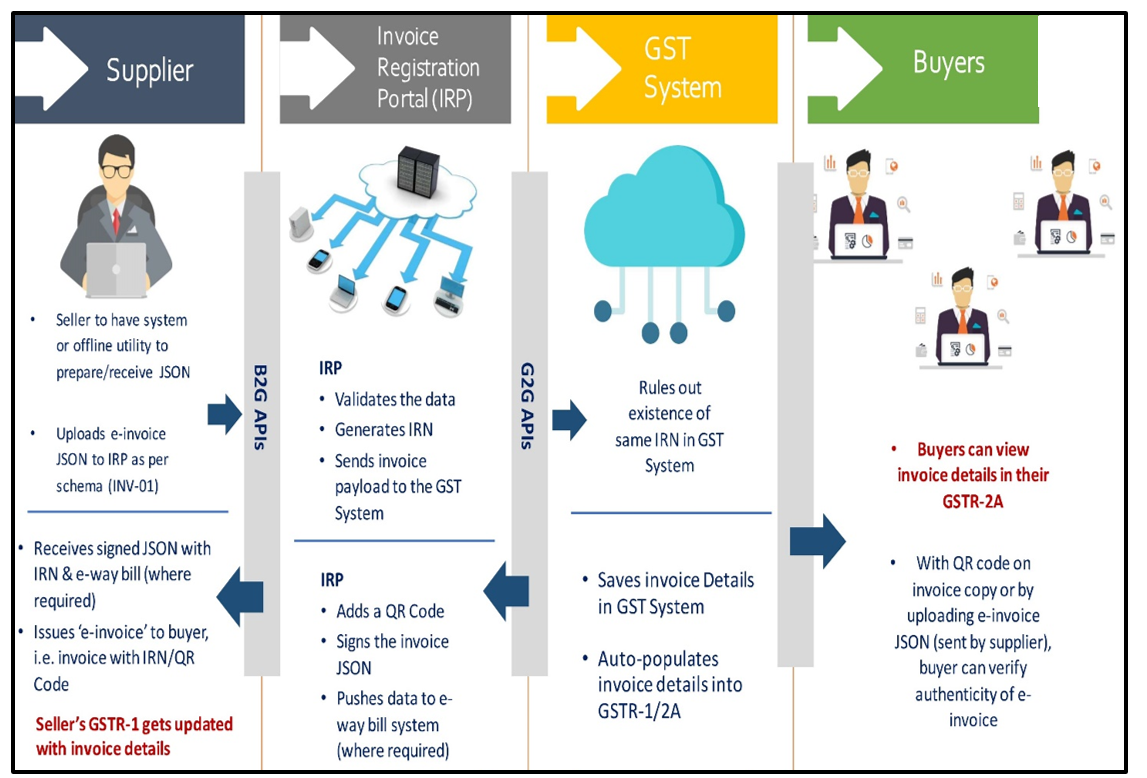

E-invoicing is the proposed system where business-to-business (B2B) invoices are digitally prepared in an e-invoicing format and authenticated by the Designated Portal - Invoice Registration Portal (IRP). This system ensures that a common format is followed by all businesses before reporting invoices to the GST portal.

- Flow of E-Invoice:

- Modes for generating E-Invoice:

The various modes of generating E-invoice are:

- Web-based – Logging into the e-invoice portal and entering the invoice data manually to generate the e-invoice.

- API/GSP based – Third-party software (Secure Folder, Excel Connector, Direct Database Access, Interface to access ERPs (Pull) and Click Button in ERP (Push))

- Offline tool based – Generating e-invoice through an offline excel tool where the data can be uploaded and exported to the IRP to generate the IRN.

- Some important points on the printing of Invoice:

- Printing of QR Code on Invoice is mandatory

- QR code can be placed anywhere in the invoice

- QR code will be digitally signed by IRP

- QR code contains IRN which has 64 encoded digits, but un-encrypted

- Quoting/printing of IRN on the paper invoice is optional

- Entities to whom E-invoicing is applicable

Type of entities

Applicable

Remarks

SEZ Units

No

Specifically exempted

Insurance Company

No

Specifically exempted

Banking Company/ Financial Institutions (including NBFCs)

No

Specifically exempted

Goods Transport Agency, Passenger Transport Services

No

Specifically exempted

Multiplex Cinema

No

Specifically exempted

Entities, other than above, having aggregate turnover more than Rs. 50 crs. in any preceding year from FY 2017-18* onwards

Yes

Applicable irrespective of turnover of current FY

Entities, other than above, having aggregate turnover more than Rs.50 Crs. in current FY but with turnover less than Rs. 50 Crs. in preceding years

No

Applicable from next FY

Entities, other than above, having aggregate turnover less than Rs.50 Crs. in preceding years from FY 2017-18 onwards

No

Cannot voluntarily register for e-invoicing

*For FY 2017-18, aggregate turnover is to be computed from 1-7-2017

- Transactions to be reported under E – Invoicing

Nature of Supplies/Transactions

Reporting

B2B Supplies

Yes

Supplies to SEZs (with/without payments)

Yes

Exports (with/without payments)

Yes

Deemed Exports

Yes

Debit Note / Credit Note w.r.t. B2B supplies

Yes

B2C Supplies

No

Supplies through E-Commerce Operator – B2B transactions

Yes

Supplies through E-Commerce Operator – B2C transactions

No

Nil Rated Supply or exempt supply

No

Person Registered under GST and also supplying services notified under section 9(3) [RCM Services]

Yes

Import of Services

No

Invoice issued by Input Service Distributor

No

Supplies between two different GSTINs under same PAN

Yes

High sea sales and bonded warehouse sales

No

- Validity and Time Limit to generate E-Invoice:

Presently, there is no validation on time limit to generate IRN. Also, there is no deeming provision which states that IRN date shall be considered as invoice date.

However, an invoice is considered valid only after its registration on the Invoice Registration Portal (IRP).

Thus, in case of Goods, e-invoice will have to be generated before the transportation of the goods i.e. movement of goods on any invoice without an IRN generation would be an invalid document.

In case of services, e-invoice needs to be generated within a reasonable time to ensure its proper reporting under GSTR-1.

Though it is e-invoice, signing on invoice will still be required. DSC is not mandatory for generation of E-Invoicing.

- Cancellation and Amendments in E-Invoice:

- IRN can be cancelled within 24 hours (from the time of generation of IRN)

- However, if the connected e-way bill is active or verified by officer during transit, cancellation of IRN will not be permitted.

- In case of cancellation of IRN, GSTR-1 also will be updated with such ‘cancelled’ status

- Amendments are not possible on IRP.

- Any changes in the invoice details reported to IRP can be carried out on GST portal (while filing GSTR-1).

- However, these changes will be flagged to proper officer for information.

- Is Dynamic QR Code different than e-invoicing?

GST mandates entities having turnover more than Rs. 500 crores in preceding years from FY 2017-18 onwards, to include a Dynamic QR code on all B2C invoices. Such QR code shall contain payment details besides other invoice details to facilitate digital transactions. It is optional to generate dynamic QR code until 30th June’21.

However, Dynamic QR Code has no relevance or applicability to ‘e-invoicing’.

Authors:

CA Shreyans Dedhia

Partner | shreyans.dedhia@masd.co.in

Meet Faria

Associate Consultant | meet.faria@masd.co.in

.svg)