Investment into Non-Debt Instruments by Person Resident Outside India

Introduction to Foreign Investment in India & its Regulations

India has sought to liberalise its economy and has continuously opened up most of its industrial and business sectors to foreign investment since 1991

Foreign investment in India is principally governed by the Foreign Exchange Management Act 1999 (FEMA) and the regulations framed thereunder, which consolidate the law relating to foreign exchange in India. To regulate foreign investment, the Reserve Bank of India (RBI) had published the Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2000 (TISPRO 2000) and thereafter TISPRO 2017 (as amended from time to time), under the FEMA was published on 7 November 2017

On 15 October 2019, the central government notified, inter alia, certain amendments to the FEMA, pursuant to which, the central government, rather than the RBI, has been granted the power of specifying all permissible non-debt instruments capital account transactions and the RBI has been granted the power of specifying all debt instruments capital account transactions.

Pursuant to these amendments to the FEMA, the central government, on 17 October 2019, notified the Foreign Exchange Management (Non-debt Instruments) Rules, 2019 (Rules 2019) and the RBI notified the Foreign Exchange Management (Debt Instruments) Regulations, 2019 (Regulations 2019) and Foreign Exchange Management (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019 (Reporting Regulations 2019)

Different Instruments of Foreign Investments:

Foreign Capital can come into India either in the form of Debt or in the of form of non-debt like Equity/Capital Participation

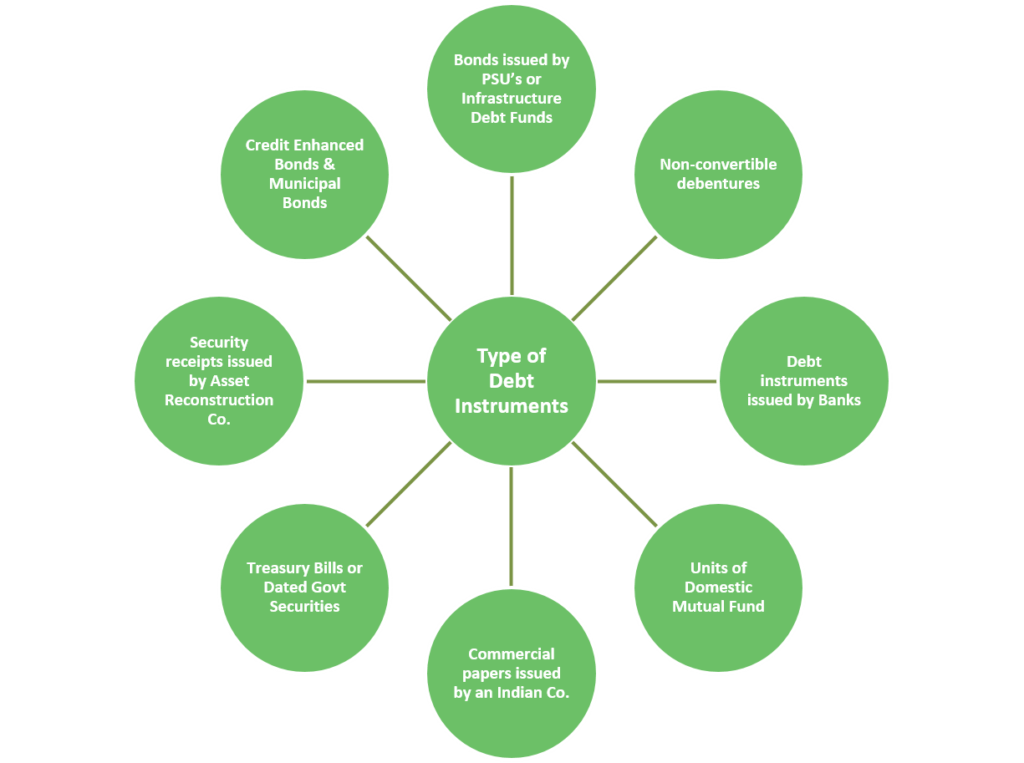

Debt Instruments:

Debt instruments means the instruments listed under Schedule 1 of the Foreign Exchange Management (Debt Instruments) Regulations 2019. It is a documented & binding obligation that provides funds to an entity in return for a promise from the entity to repay the lender or investor in accordance with terms of a contract.

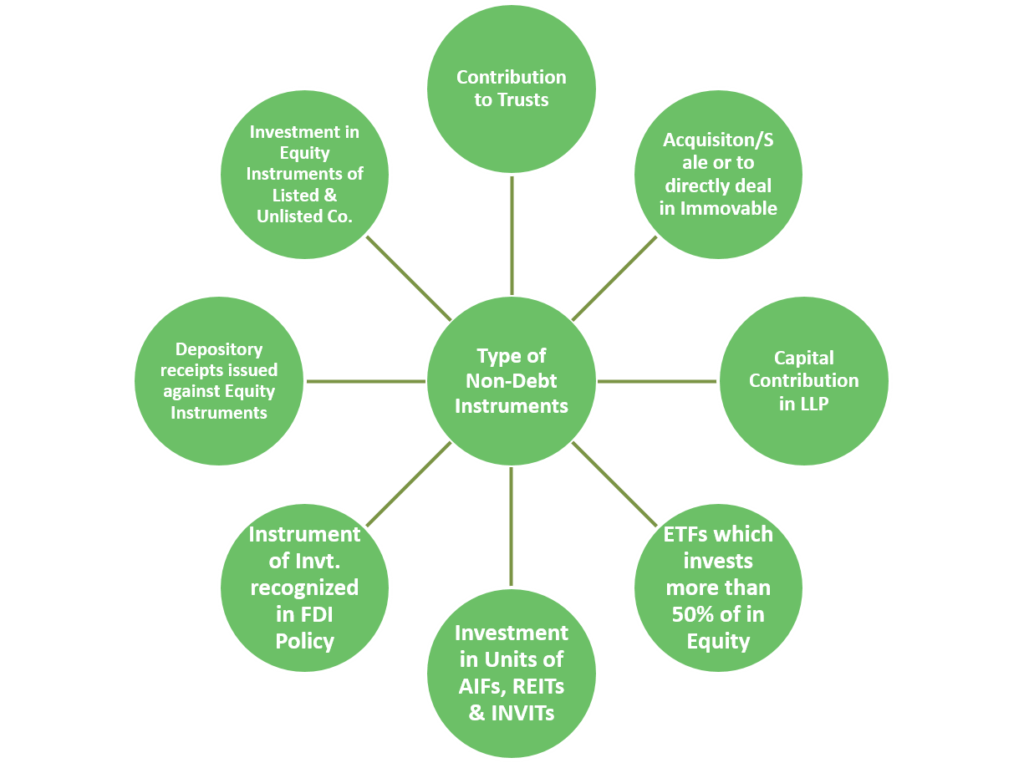

Non-Debt Instruments:

Non -Debt instrument means the instruments listed under Chapter I of the Foreign Exchange Management (Non-Debt Instruments) Rules 2019.

Criteria for Foreign Investment Into Non-Debt Instruments

Country of Concern:

1.India welcomes citizens of almost all countries to invest in India. However, with effect from 17 April 2020, citizens / companies of all countries that share land border with India (Pakistan, Bangladesh, China, Nepal, Afghanistan, Bhutan, and Myanmar) require government approval even when investing in sectors that are under automatic route. Notably, entities from other countries with beneficiary / beneficiaries from any of these countries will also need government approval

2.Further, a citizen of Pakistan or an entity incorporated in Pakistan can invest, only under the Government route, in sectors/activities other than defence, space, atomic energy and sectors/activities prohibited for foreign investment

3.In the event of the transfer of ownership of any existing or future FDI in an entity in India, directly or indirectly, resulting in the beneficial ownership falling within the restriction of the two above mentioned points, such subsequent change in beneficial ownership will also require Government approval.

Entry Routes for Foreign Investment:-

Every non-resident entity is allowed to invest in India either under Automatic or Government Approval Route, except in prohibited sectors. The detailed FDI policy by DPIIT - https://dipp.gov.in/foreign-direct-investment/foreign-direct-investment-policy

.svg)